This Are The Three Books You Need To Read This Year If You Want To Get Out of Debt And Built Wealth in 2022

There are thousands of books published each year that promise the secrete to make money or get out of debt. Most of them are full of fluff and useless repetitive information. Honestly not worth the reading.

These are the three books that will give you a foundation to get your finances in order and become wealthy.

**UPDATED AND REFRESHED FOR BITCOIN / CRYPTO ERA INTERNATIONAL BEST-SELLER: TRANSLATED AND PUBLISHED WORLDWIDE IN OVER 15 LANGUAGES

Has the "settle-for-less" financial plan become your plan for wealth? That sounds something like this:

Graduate from college, get a good job, save 10% of your paycheck, buy a used car, cancel the movie channels, quit drinking expensive Starbucks mocha lattes, save and penny-pinch your life away, trust your life-savings to Wall Street, and one day, when you are oh, say, 65 years old, you can retire rich.

Since you were old enough to hold a job, you've been hoodwinked to believe that wealth can be created by blindly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. This soul-sucking, dream-stealing dogma is "The Slowlane" - an impotent FINANCIAL GAMBLE that dubiously promises wealth in a wheelchair.

Accept the Slowlane as your financial roadmap and your financial future will blow carelessly asunder on a sailboat of HOPE: HOPE you can get a job and keep it, HOPE the stock market doesn't tank, HOPE for a robust economy, HOPE, HOPE, and HOPE. Is HOPE really the centerpiece of your family's financial plan?

Drive the Slowlane and you will find your life deteriorate into a miserable exhibition about what you cannot do, versus what you can. For those who don't want a lifetime subscription to mediocrity, there is an alternative; an expressway to extraordinary wealth capable of burning a trail to financial freedom faster than any road out there. And shockingly, this road has nothing to do with jobs, 401(k), mutual funds, or a lifestyle of miserly living and 190 square foot tiny houses. Just some of what you will learn:

Why jobs, 401(k)s, mutual funds, and 40-years of mindless frugality will never make you rich young. Why most entrepreneurs fail and how to immediately put the odds in your favor. The real law of wealth: Leverage this and wealth has no choice but to be magnetized to you. The leading cause of poorness: Change this and you change everything. How the rich really get rich - and no, it has nothing to do with a paycheck or a 401K match. The mathematics of wealth and how any "Joe Schmo" can tap into real wealth real fast. Why the guru's sacred deities - compound interest and indexed funds - are impotent wealth accelerators. Why popular guru platitudes like "do what you love" and "follow your passion" will most likely keep you poor, not rich.

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people. Money―investing, personal finance, and business decisions―is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics. …

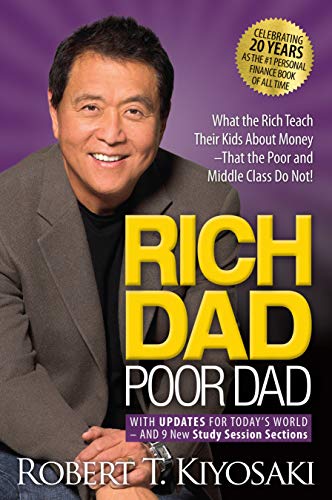

It's been nearly 25 years since Robert Kiyosaki’s Rich Dad Poor Dad first made waves in the Personal Finance arena. It has since become the #1 Personal Finance book of all time... translated into dozens of languages and sold around the world.

Rich Dad Poor Dad is Robert's story of growing up with two dads — his real father and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

20 Years... 20/20 Hindsight In the 20th Anniversary Edition of this classic, Robert offers an update on what we’ve seen over the past 20 years related to money, investing, and the global economy. Sidebars throughout the book will take readers “fast forward” — from 1997 to today — as Robert assesses how the principles taught by his rich dad have stood the test of time.

In many ways, the messages of Rich Dad Poor Dad, messages that were criticized and challenged two decades ago, are more meaningful, relevant and important today than they were 20 years ago.

As always, readers can expect that Robert will be candid, insightful... and continue to rock more than a few boats in his retrospective.

Will there be a few surprises? Count on it.

Rich Dad Poor Dad... • Explodes the myth that you need to earn a high income to become rich • Challenges the belief that your house is an asset • Shows parents why they can't rely on the school system to teach their kids about money • Defines once and for all an asset and a liability • Teaches you what to teach your kids about money for their future financial success